Remember, No-Fault will pay 80% of your salary up to $2000 per month.

In this instance you are not entitled to lost wages through No-Fault. injured while in a vehicle that is known to be stolenĮmployee Benefits & No-Fault Coverage for Lost WagesĪnother instance where No-Fault will not reimburse you for lost wages is if you receive a benefit from your employer that exceeds the maximum No-Fault payout.įor example, if your employer pays you $500 per week while you are out of work this amounts to $2,000 per month.

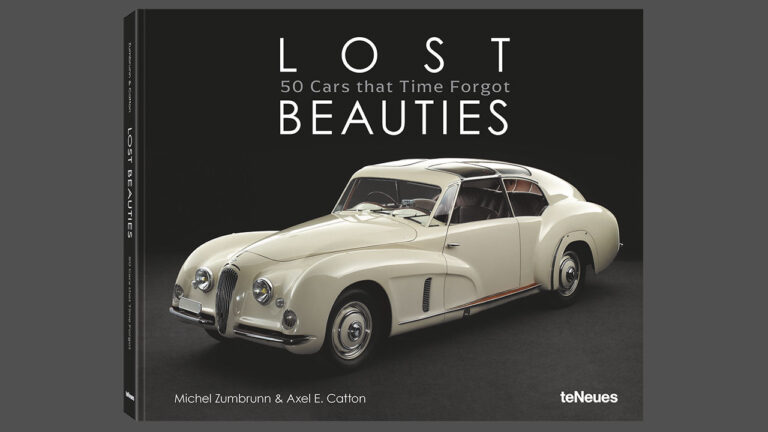

AUTOS LOST TO TIME DRIVER

riding an all-terrain vehicle or motorcycle as the driver or passenger.injured during the commission of a felony.intentionally causing his or her own injuries.driving while intoxicated or under the influence of drugs.For instance, No-Fault would not cover lost wages from an accident if a person were: There are situations under most policies that would disqualify a person from being able to recover lost income or doctor expenses through No-Fault benefits. No-Fault will then pay $300 in lost wages ($800 – $500 = $300).Ĭlick to contact our personal injury lawyers today Are There Situations Where No-Fault Will Not Reimburse My Lost Wages? In this example, you will receive $125 per week from New York State disability for a total amount of $500 per month ($125 = half of $250 weekly salary). New York State disability will pay half of your salary up to $170/week. Therefore, you are entitled to receive $800 per month in lost wages.īut before you are paid by No-Fault, you will first be reimbursed by New York State disability. No-Fault will pay 80% of your salary up to $2000 per month – 80% of $1,000 is $800. If you’re experiencing economic loss and desperately need to cover your medical bills and other expenses, New York State disability will pay you first, then No-Fault will reimburse the remaining amount if any for your lost wage claim.įor example: if you earn $250 per week or $1,000 per month. An Example Lost Wage Payout for a Motor Vehicle Accident New York State disability benefits will reimburse you for half of your pay, up to $170 per week. If you’ve been there for a shorter period of time, then New York State looks to your prior employer. You must be employed with your current job for at least four weeks to apply through your employer. If you’ve experienced lost earnings from a serious injury, No-Fault requires that you file for New York State disability through your employer.

One other benefit is that when it comes time to file your tax returns, these pay-outs will be tax-free. If you were in a motor vehicle accident and filed for no-fault benefits, but haven’t yet consulted with an attorney, you may be surprised to know that part of your lost wages may be covered.īasic No-Fault auto insurance typically covers 80% of lost earnings from work, up to $2,000 per month for up to three years from the date of the car accident. $2,000 death benefit (in addition to the $50,000 basic No-Fault insurance limit) payable to the victim’s estate.ĭo you have questions about No-Fault Insurance Coverage? Get help from the experienced car accident lawyers at Rosenburg & Gluck.Up to $25 a day for reimbursement of necessary household help expenses, as well as travel expenses to travel for medical treatments.This is subject to offsets for disability, Worker’s Compensation and Federal disability benefits. 80% of lost earnings from work to a maximum of $2,000 a month for up to 3 years from the date of the accident.Reasonable and necessary accident-related medical and recovery expenses.According to New York State’s Department of Financial Services, No-Fault Insurance or Personal Injury Protection (PIP), will cover: No-Fault insurance is required by New York State, as is Liability and Uninsured Motorist insurance. This type of coverage does not include repairs to any cars that were involved in the accident - including yours. This may include transportation to and from your doctor in the case of a personal injury. No-Fault coverage doesn’t only cover lost earnings if you are unable to work and medical expenses, but also additional compensation for necessary expenses for drivers, passengers, or pedestrians who’ve been injured by your car.

0 kommentar(er)

0 kommentar(er)